Standard emission accounting methods

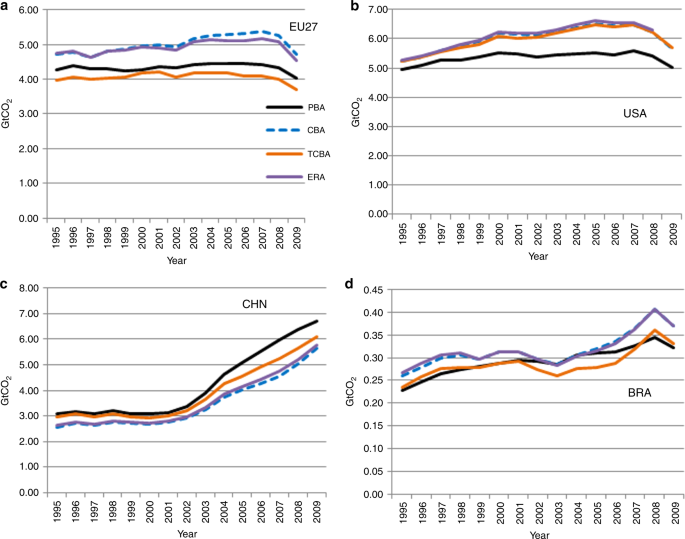

This section presents the standard PBA and CBA, TCBA (proposed by Kander et al.4) and TCBA* (TCBA with the modification proposed by Domingos et al.5, implemented in Kander et al.62). Supplementary Note 1 of the SI gives the full methodological framework for PBA, CBA, TCBA, TCBA*, and ERA. Here, we only present the main equations.

If one aims at reducing global emissions, one would like to develop a scheme to credit actions by one or more countries that reduce global emissions and penalize actions that increase global emissions. It is well known that CBA does not satisfy in this respect and sends out perverse stimuli. This led Kander et al.4 to adjust the original CBA and remedy this shortcoming. The example in Supplementary Note 2 of the SI shows, however, that also TCBA and TCBA* may penalize a country that engages in trade that reduces global emissions.

The emission intensities (g_i^R) give the emissions per unit (e.g., dollar) of production in industry i (=1, …, n) of country R (=1, …, N). The element (l_{ij}^{RS}) of the Nn × Nn matrix L gives the production in industry i of country R that is necessary for one dollar of consumer demand for final product j produced in country S. The emission multiplier is given by (sum_R sum_i g_i^Rl_{ij}^{RS})and tells how much is emitted globally for one dollar of consumer demand for final product j produced in country S.

The PBA (minus the emissions directly by households) for country R is given by

$${mathrm{PBA}}^R = mathop {sum }limits_i g_i^Rx_i^R = mathop {sum }limits_i g_i^Rleft( {mathop {sum }limits_T x_i^{RT}} right)$$

(1)

where (x_i^R) gives the production in industry i of country R and (x_i^{RT}) gives the production in industry i of country R that is embodied in all consumer demand in country T for final products. The CBA (minus the emissions directly by households) is for country R given by

$${mathrm{CBA}}^R = mathop {sum }limits_T mathop {sum }limits_i g_i^Tx_i^{TR} = PBA^R – mathop {sum }limits_{T ne R} mathop {sum }limits_i g_i^Rx_i^{RT} + mathop {sum }limits_{T ne R} mathop {sum }limits_i g_i^Tx_i^{TR}$$

(2)

CBA equals PBA minus the export of domestic emissions plus the import of foreign emissions. For the TCBA, the domestic emission coefficients ((g_i^R)) are replaced in the exports of emissions by world market average emission coefficients ((bar g_i^{})), with

$$bar g_i^{} = frac{{left( {mathop {sum }nolimits_S mathop {sum }nolimits_{T ne S} g_i^Sx_i^{ST}} right)}}{{left( {mathop {sum }nolimits_S mathop {sum }nolimits_{T ne S} x_i^{ST}} right)}}$$

(3)

This yields

$${mathrm{TCBA}}^R = PBA^R – mathop {sum }limits_{T ne R} mathop {sum }limits_i bar g_ix_i^{RT} + mathop {sum }limits_{T ne R} mathop {sum }limits_i g_i^Tx_i^{TR}$$

(4)

Domingos et al.5 propose to also apply the world market average coefficients in Eq. (3) to the imports. In that case, the adapted TCBA becomes

$$left( {{mathrm{TCBA}}^ ast } right)^R = {mathrm{PBA}}^R – mathop {sum }limits_{T ne R} mathop {sum }limits_i bar g_ix_i^{RT} + mathop {sum }limits_{T ne R} mathop {sum }limits_i bar g_ix_i^{TR}$$

(5)

Emission responsibility allotments

The example in Supplementary Note 2 of the SI shows that CBA and its adjustments TCBA and TCBA* suffer challenges as basis for a scheme of credits and penalties. The example considers a situation of pure Ricardian trade (with comparative advantage defined in terms of emitting the least CO2) and finds that one of the trading partners is penalized while trade reduces global emissions. Therefore, we need an adapted framework and for this we propose to use the ERAs. If the aim is to reduce global emissions then any action (such as additional trade) that decreases (increases) emissions should be credited (penalized). Moreover, the larger the reduction in emissions the larger the credits. ERAs adapt CBA on the basis of the gains and losses for global emissions. The situation where the traded goods had been produced at home is used as a benchmark. Next, we present the method to determine ERAs after which we discuss desirable properties imposed on schemes of credits and penalties in section 3.

For ERAs, we start with the global emissions that are embodied in the final goods that are produced in R and consumed (or used as investments) in country S. This is to be compared with the case where the exports of emissions had not taken place. Instead, all final goods are assumed to have been produced at home in country S.

The situations to be compared are: first, the actual situation where country S buys its final products (for consumption and investment purposes) in country R; and, second, the hypothetical case in which country S had produced these final products at home. It should be stressed that the counterfactual only affects the trade in final products. In principle one could extend the analysis to include also the trade in intermediates. That is, instead of buying intermediates in country R, produce them at home in country S.

The central idea in Ricardian theory is that a country should export the goods and services in which it is best in terms of production. This holds, even if it is always worse than its trading partner. If countries trade in this way they both will gain from trade. Best is defined as using the least amount of the scarce resource under consideration. Traditionally, that was labor and more trade leads to increased welfare in both countries. Alternatively, however, one could take environmental aspects into consideration. For example, define best as generating the least amount of emissions in the production of a certain good or service63, or using the least amount of water64. In that case, increased trade will reduce the emissions (or water consumption) in each of the two trading countries.

Final consumers (and clients in general) are a powerful force in persuading producers to act in a responsible way, as witnessed by the growing literature on corporate social responsibility. This also applies to their responsibility for the environment. Despite the problem of having constraints in MRIO on compilation product-specific data that might require time to see great accuracy and detail, through labeling, consumers can be informed how much CO2 or GHGs are embodied in a certain final product. If the consumers’ environmental concern is sufficiently large they may decide not to buy the cheapest alternative but the alternative that is produced the cleanest. Something similar has happened before with campaigns aiming to ban brands that sell final products embodying child labor65,66. According to Ballet et al.67: “the basic strategy for the fight against child labor has been boycotting efforts followed by labeling practices”.

Bearing the role of consumers in mind, we have chosen to develop ERAs for the case of trade in final products. Yet, Supplementary Note 4, however, shows what the framework looks like if we develop a scheme of credits and penalties based on trade in intermediate products. This would directly incentivize producers to trade better.

Our scheme of assigning credits and penalties is based on the idea that it takes two to tango. Both countries are credited (penalized) equally if their bilateral trade decreases (increases) global emissions. The amount of the credit or penalty is determined by comparing the actual situation with the hypothetical situation that imports of emissions had been replaced by emissions at home. Consider two countries: R and S. Let (e_i^R) indicate the emission multiplier, i.e., the global emissions that are generated somewhere in the production chain of one unit (say dollar) of final demand for good i from country R. Let (y_i^{RS}) indicate the final demand in country S for good i from country R. The global emissions involved in the imports by S of final goods from R are given by (sum_i e_i^Ry_i^{RS}). This is to be compared with the hypothetical situation in which these imports (by S from R) had been produced at home (i.e., in S). In that case, the global emissions would have been (sum_i e_i^Sy_i^{RS}). If the difference (sum_i (e_i^R – e_i^S)y_i^{RS}) is negative (positive), it gives the reduction (increase) in global emissions and reflects the gains (losses) from the exports from R to S. Vice versa, the imports by R from S (which are equal to the exports from S to R) changes global emissions by (sum_i (e_i^S – e_i^R)y_i^{SR}). The extra emissions due to bilateral trade are given by

$$mathop {sum }limits_i left( {e_i^R – e_i^S} right)left( {y_i^{RS} – y_i^{SR}} right)$$

(6)

and a negative outcome indicates reduction of global emissions.

Note that the gains and losses above were derived from the viewpoint of country R. That is, exports from R (to S) and imports by R (from S). The same answer is obtained if the calculation is done from the viewpoint of country S, implying symmetry. We thus assign half of the gains or losses, i.e., ((1/2)sum_i (e_i^R – e_i^S)(y_i^{RS} – y_i^{SR})), to each of the two countries. The outcome points at a credit if it is negative and a penalty if it is positive. In the case of N countries, the changes in global emissions due to trade by country R are given by

$$(1/2)mathop {sum }limits_S mathop {sum }limits_i left( {e_i^R – e_i^S} right)left( {y_i^{RS} – y_i^{SR}} right)$$

(7.)

It should be stressed that the outcomes are particularly relevant when their development over time is considered. The numbers themselves involve a comparison of the actual situation with a hypothetical no-trade case. Comparing the numbers over time, however, allows to analyze the effect of changes in trade (next to changes in emission efficiency and production technology).

A final adaptation makes the scheme satisfy the condition of additivity. The extra emissions due to bilateral trade between R and S are given by (sum_i left( {e_i^R – e_i^S} right)left( {y_i^{RS} – y_i^{SR}} right)) and ((1/2)sum_i (e_i^R – e_i^S)(y_i^{RS} – y_i^{SR})) is assigned to each of the two countries. The average extra global emissions due to bilateral trade are given by

$$a = left[ {(1/2)mathop {sum }limits_R mathop {sum }limits_S mathop {sum }limits_i left( {e_i^R – e_i^S} right)left( {y_i^{RS} – y_i^{SR}} right)} right]/N$$

(8)

as there are N countries. For country R, instead of using ({mathrm{CBA}}^R = sum _S sum_i e_i^Sy_i^{SR}), we propose to use the ERA defined as

$${mathrm{ERA}}^R = {mathrm{CBA}}^R + (1/2)mathop {sum }limits_S mathop {sum }limits_i left( {e_i^R – e_i^S} right)left( {y_i^{RS} – y_i^{SR}} right) – a$$

(9)

where the penalty is given by ((1/2)sum_S sum_i (e_i^R – e_i^S)(y_i^{RS} – y_i^{SR}) – a). Equation (9) shows that country R is credited if its trade leads to a reduction of the global emissions that is larger than the average reduction due to trade. In that case is the penalty negative and do we have ({mathrm{ERA}}^R; <; {mathrm{CBA}}^R). Our scheme of credits and penalties (as follows directly from ERA) is based on the gains in global emissions due to the trade in final products by country R (relative to the average country’s gains in global emissions). As we will discuss in section 3, the scheme of credits and penalties satisfies all three desirable properties mentioned in Kander et al.4.

In the Supplementary Note 1 (subsection 1.4) of the SI, we provide an illustration of the functioning of the method for three countries and two goods. We also extend the method to the industry level, which is illustrated in subsection 1.5 of Supplementary Note 1 in the SI.

Desirable properties for credits and penalties

Kander et al.4 formulate three important and intuitively compelling properties for a scheme of credits and penalties. These three properties are a subset of the six properties listed in Rodrigues et al.6 and Domingos et al.5, albeit using a different terminology. The three properties in are4: sensitivity, monotonicity, and additivity. The additional three properties are6: economic causality, symmetry, and scale invariance. In our discussion, we start with the three properties and show that ERAs satisfy these properties. After that we indicate why economic causality and symmetry are not relevant in the present context. We also discuss why the requirement of scale invariance, which was at the heart of the comment by Domingos et al.5, is not met by CBA, TCBA (nor indeed TCBA*), and ERA and why it may not be so desirable.

The first property, i.e., sensitivity, means that the credits and penalties are “responsive to factors that nations can influence” (Kander et al.4). Typical examples of such factors are: changes in final demands (not only levels but also the composition of the bundle) that decrease global emissions; decreases in emission intensities; and changes in the production structure (e.g., a larger productivity in the sense of using less intermediate inputs per unit of output, or replacing the import of intermediate inputs from a dirty country by imports from a clean country). Supplementary Note 3 of the SI provides the technical details and shows that ERAs are sensitive in the sense that they are responsive to factors that a country can influence and that affect global emissions.

The second property, i.e., monotonicity, states that a country should not be able to reduce its own carbon responsibility by increasing global emissions4. So, a country should not be credited for actions that increase global emissions or penalized for actions that reduce global emissions. This is a very strict definition, using increases and decreases in absolute terms. ERAs and the underlying scheme of credits and penalties do not satisfy this property. However, they are constructed to satisfy a slightly weaker form of monotonicity that uses changes in global emissions in relative terms. Countries are credited (or penalized) if their national actions reduce global emissions more (or increase them less) than average. Also, the larger the reduction in global emissions the larger the credit (or the smaller the penalty).

The third property is additivity and requires that “the sum of national emissions for all countries should equal total global emissions” (Kander et al.4). Recall that Eq. (8) introduced the average extra global emissions due to bilateral trade. The ERAs in Eq. (9) corrected the CBA for a reduction in global emissions due to trade that is larger than the average reduction due to trade. The initial set of credits and penalties was rescaled to make the sum of all responsibilities equal to the global emissions. This led to additivity.

When discussing the three additional properties (economic causality, symmetry, and scale invariance), it should be emphasized that the approach in Rodrigues et al.6 is slightly different. For any economic flow, they distinguish between its upstream and its downstream environmental pressure. Gallego and Lenzen3 provided a comprehensive framework on the upstream and downstream perspectives68. CBA (and TCBA and ERA) only considers an upstream perspective and simply has no downstream perspective. Economic causality requires a proportional link between the upstream and downstream environmental pressure and an economic flow. Symmetry requires that the upstream environmental pressure of flow (i, j) equals the downstream pressure of flow (j, i). Given the different viewpoint on (re)distributing environmental pressures and the role of distinguishing between upstream and downstream pressures, neither economic causality nor symmetry is relevant in the present context (with only an upstream perspective).

It should be mentioned that a different type of symmetry does apply in the case of ERAs. That is, the gains and losses (in terms of changes in global emissions) of bilateral trade between countries R and S, are the same no matter whether they are evaluated from the perspective of R or of S. Both perspectives yield the same answer. The credit or penalty that follows from the gain or loss is the same for both trading partners if they share the consequences equally.

In the comment by Domingos et al.5 and the response by Kander et al.62, the focus is on the last of the remaining properties, namely scale invariance. It means that, for any union of countries, the sum of emission responsibilities for all countries in the union must equal the emission responsibility of the union if it were treated as a single country. Domingos et al.5 argue that TCBA does not satisfy the scale invariance condition and come up with an alternative.

We argue that CBA, TCBA, but also the method proposed by5 and our own ERA do not satisfy scale invariance. The reason is that any method in IO analysis that is based on the Leontief inverse suffers from aggregation bias. The underlying idea is as follows. At the aggregate level, one may provide two answers to a single question. One answer is obtained from aggregation after calculation, the other answer from calculation after aggregation. Suppose we have a large GMRIO table and suppose that a number of individual countries form a union (like EU27 in the WIOD tables). In the case of aggregation after calculation, we first calculate the answer using the full GMRIO table and then aggregate the answers for the individual countries in the union to arrive at the answer for the union. In the case of calculation after aggregation, we first aggregate the GMRIO table to arrive at a smaller table that includes the union as if it were a single country. Next, we run the calculations on this aggregated table that yields answers for individual countries, one of which represents the union. These two types of calculation yield the same answer only under very strong properties that do not hold in real world cases, or by sheer coincidence41. In general, the answers will differ and the difference is termed aggregation bias. Because the Leontief inverse L is a non-linear function of the input matrix A (({mathbf{L}} = ({mathbf{I}} – {mathbf{A}})^{ – 1} = {mathbf{I}} + {mathbf{A}} + {mathbf{A}}^2 + ldots)), questions for which the answer involves the use of L suffer from aggregation bias. This raises the question whether scale invariance is such a desirable property. If it is, the accounting framework cannot be based on the IO model, because this model uses L that makes the framework scale variant. PBA is an example of an accounting framework that satisfies the condition of scale invariance (and that—indeed—does not use an IO model).

Reporting summary

Further information on research design is available in the Nature Research Reporting Summary linked to this article.

Source: Ecology - nature.com